Open an Account

Conveniently and securely open a new account online

Join our family by opening a Free Checking account

Open a checking account to access all we have to offer

Savings

Explore new ways to save with Online Savings, Money Market and CDs

Credit cards

Find a credit card with features that work for you, like travel rewards and cash back

Mortgages

Buy or refinance a home with an adjustable or fixed-rate mortgage

Loans

Apply for an auto, home or personal loan to help you achieve your goals

Insurance

Insure what matters most and protect yourself from the unexpected

Why choose First Citizens?

Because we've been helping families and businesses just like yours make more of their finances for more than 120 years. We've shared their dreams, helped make their budgets work harder and built solid financial plans to last them the rest of their lives. And in that time, we've built a solid track record of service, stability and reliability.

Our Forever First Promise

Forever First® means the name on our door will stay the same for years to come.

Forever Stable

Taking care of customers—year in, year out—isn’t just our track record. It’s our promise.

Forever Family

We're one of America’s largest family-controlled banks, led for three generations by members of one family.

Bank from anywhere with your mobile devices

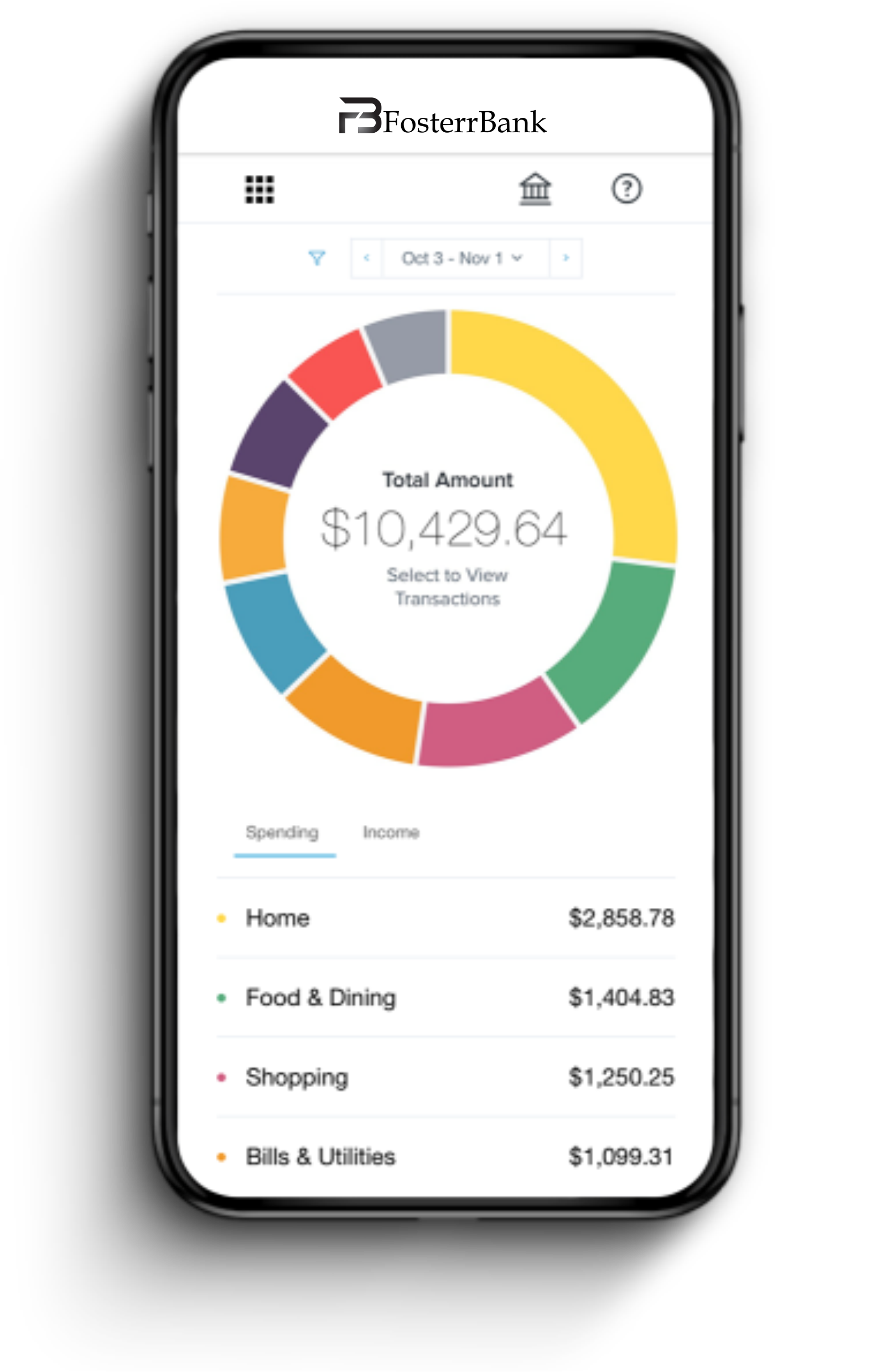

Track your spending habits

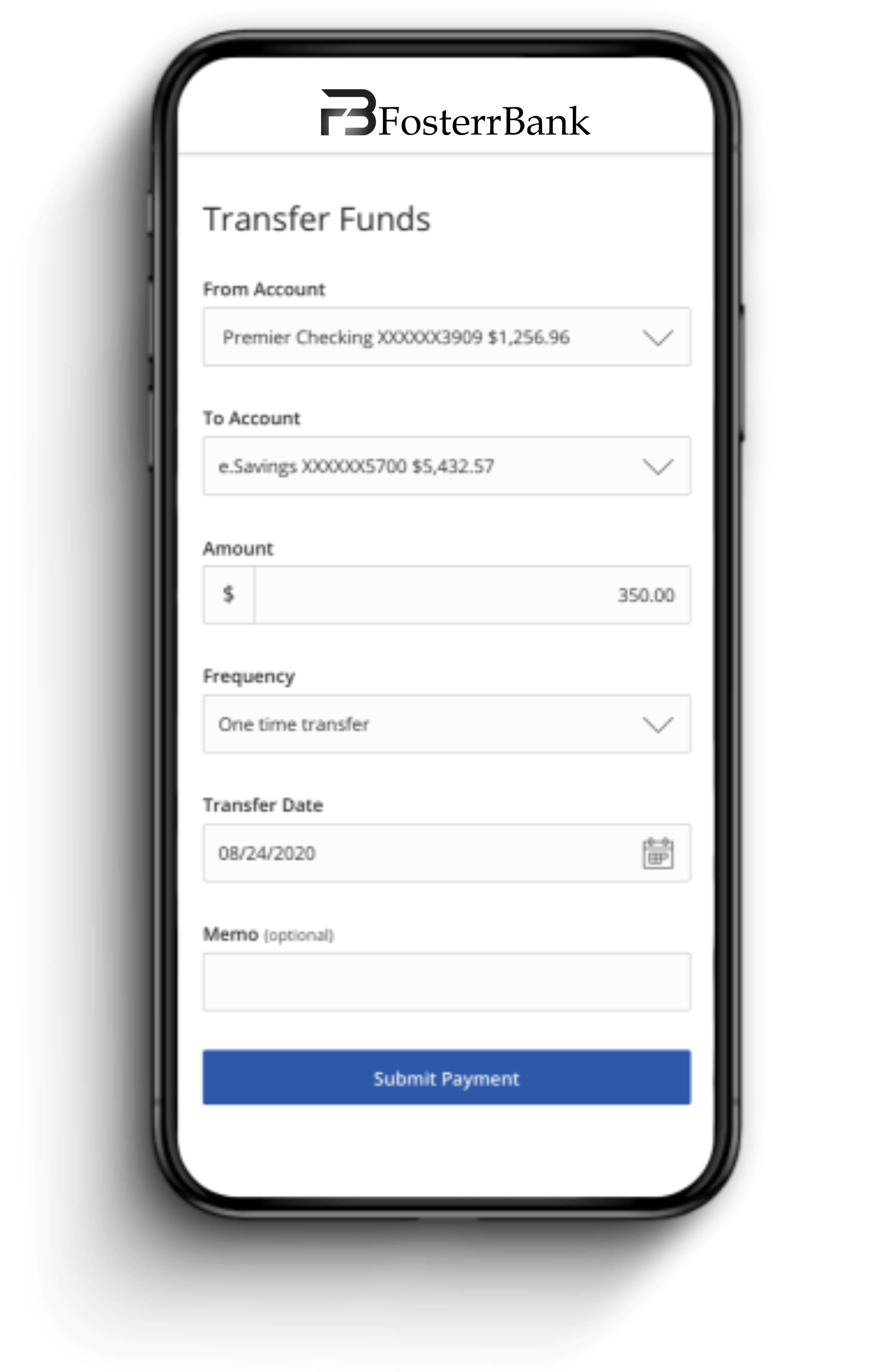

Seamlessly move your money

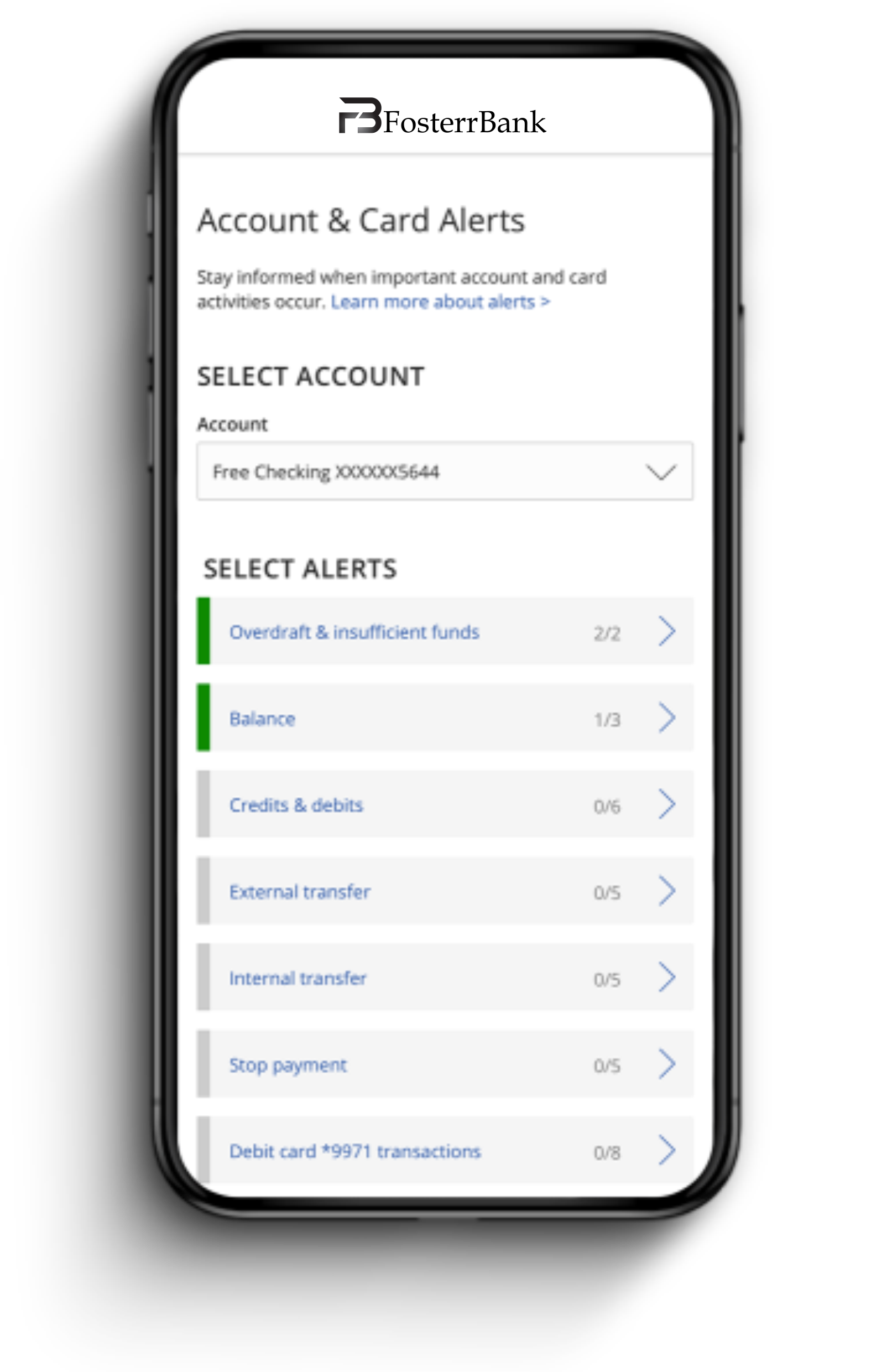

Set alerts for transactions

The same secure banking you've come to rely on in person, online

Security Alerts

We'll automatically send you alerts if your account credentials change.

Card Freezes

Temporarily freeze or unfreeze your card if it's lost or stolen, or if you suspect fraud.

Advanced Security

Rest assured that all your confidential account information is protected.

Insured

Your money is insured by the Federal Deposit Insurance Corporation.