Bank Loans

Get the funds you need to achieve your goals

Money Saver Mortgages

Take advantage of today's low rates to decrease your monthly mortgage payment.

Home Improvement and Home Equity

Get the funds you need to start your next project at home.

Auto Loans

Get a great fixed rate for your new or new-to-you ride.

Personal Loans

Find an affordable way to achieve your goals.

Is it time to consolidate your debt with a bank loan?

Bank from anywhere with your mobile devices

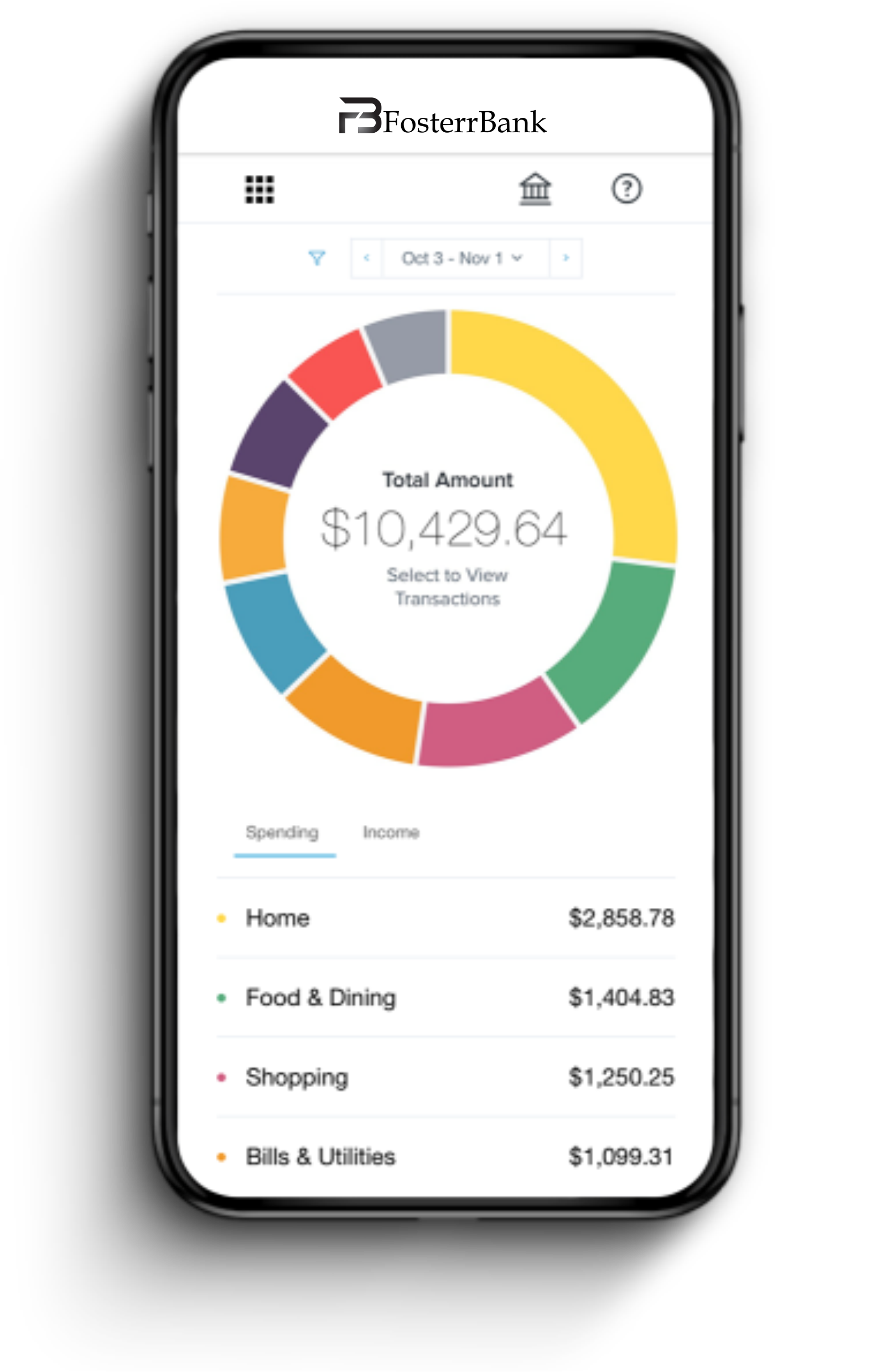

Track your spending habits

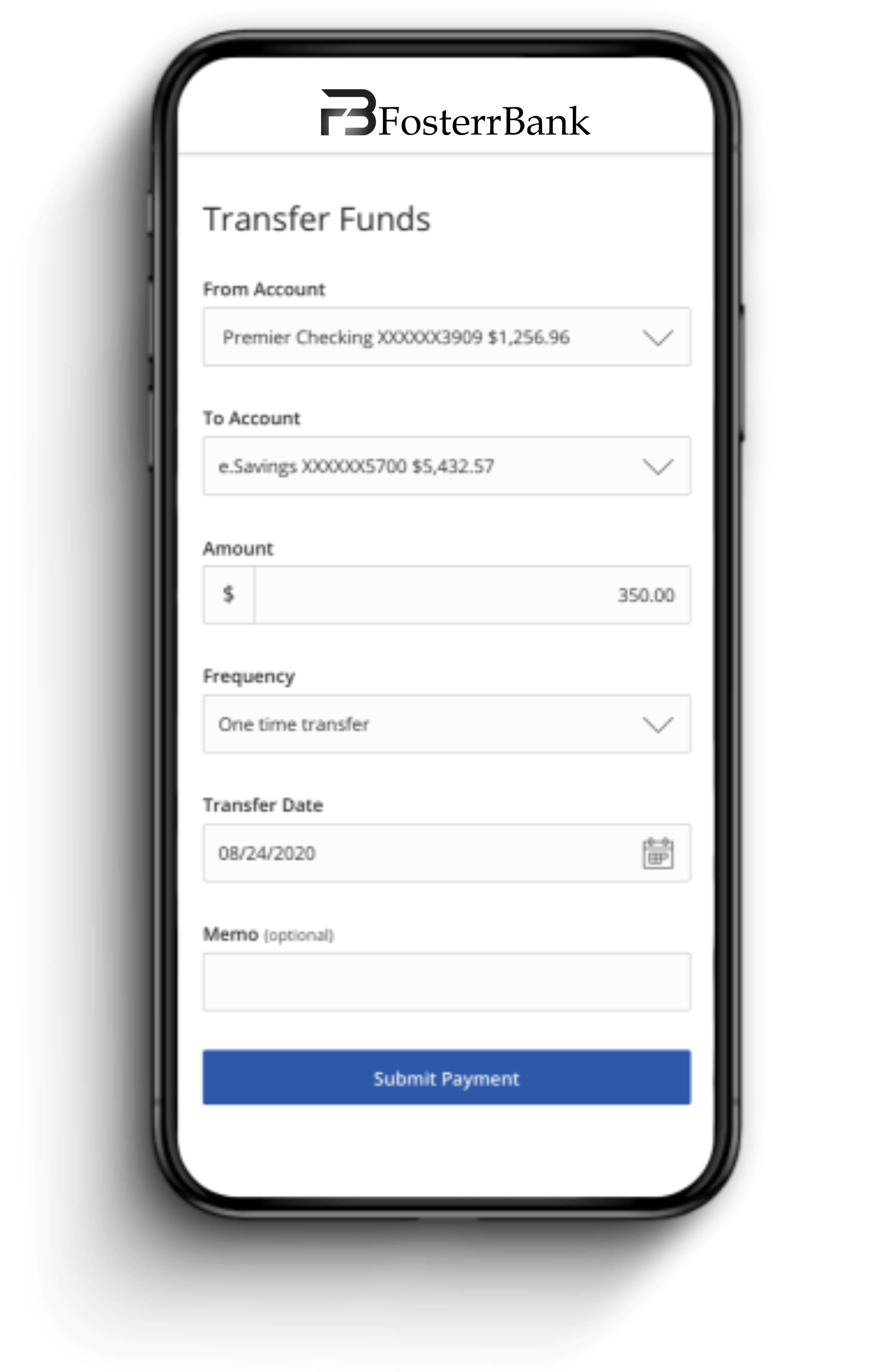

Seamlessly move your money

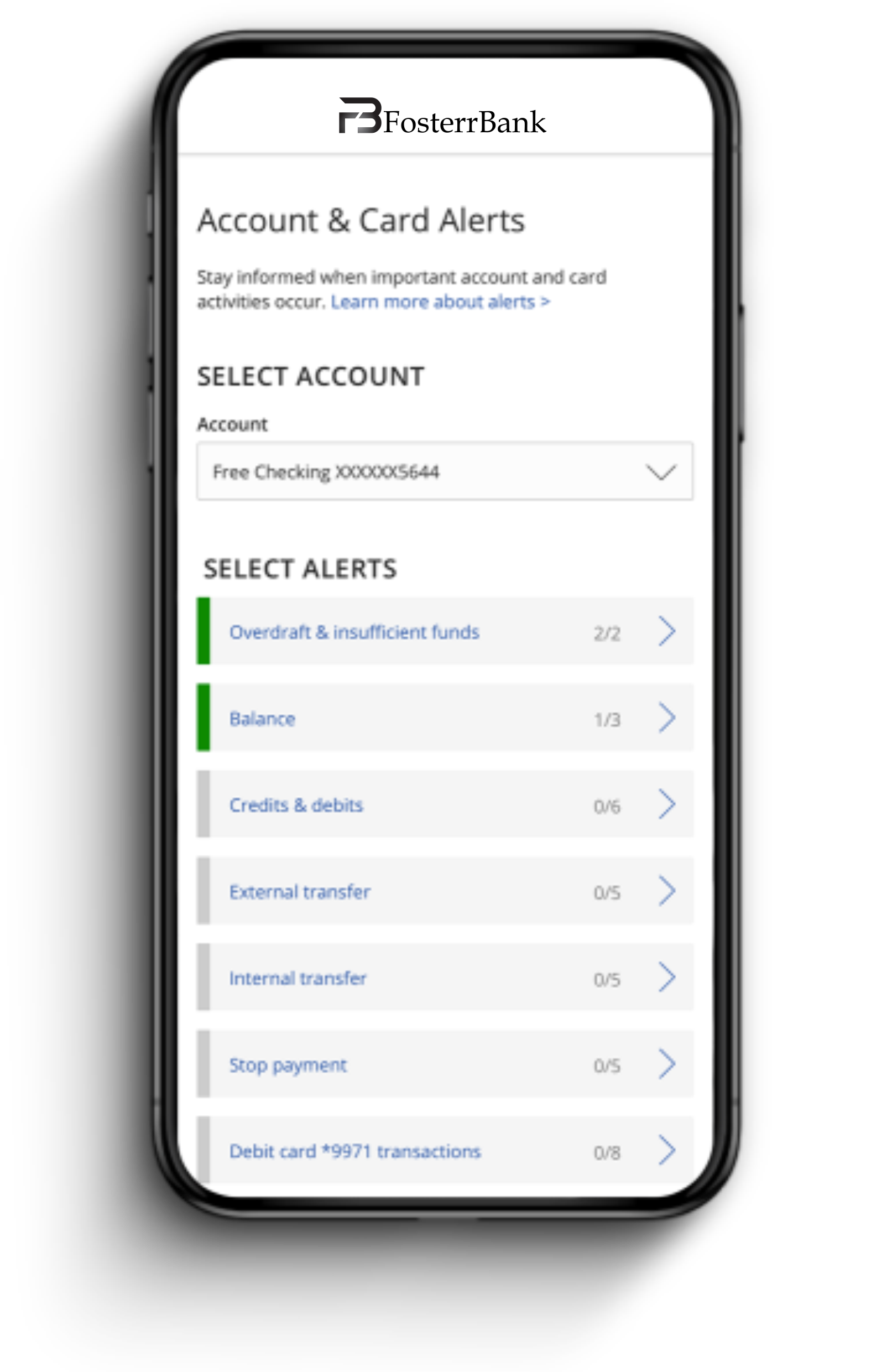

Set alerts for transactions

The same secure banking you've come to rely on us for in person, online

Security Alerts

We'll automatically send you alerts if your account credentials change.

Card Freezes

Temporarily freeze or unfreeze your card if it's lost or stolen, or if you suspect fraud.

Advanced Security

Rest assured that all your confidential account information is protected.

Insured

Your money is insured by the Federal Deposit Insurance Corporation.